As time goes on, technology has had a tendency to increase exponentially. Just think about it: only 100 years ago were cars becoming some of the most popular new technological gadgets in the world. These days there are billions of cars on the market. Most of them would seem like completely alien creations when looked at from the perspective of someone who lived 100 years ago. This increasing technological expansion is affecting many different professions in both negative and positive ways. However, it is being felt very seriously in the world of accounting.

For some time now, Los Angeles accountants have been some of the most successful and proficient financial service providers in the world. Their expertise and depth of knowledge about the tax in America is second to none, which is why most people and large companies go to them to get their taxes prepared. However, there is bit of a shakeup in recent years. Software is being developed that has the potential to completely automate the jobs of many accountants.

All of the corporate accounts that require extremely deep knowledge of accounting rules and complex calculations and judgments are safe…for now. The area of the market that is being taken out by software is the personal tax market. In the past, many people had to go through a licensed CPA or over to a commercial tax-preparation service in order to get their taxes done accurately and quickly. It simply took too much time and effort to do it on their own, so paying anywhere from $150 to $1000 to have their taxes prepared was a reasonable expense.

Automating Accountants

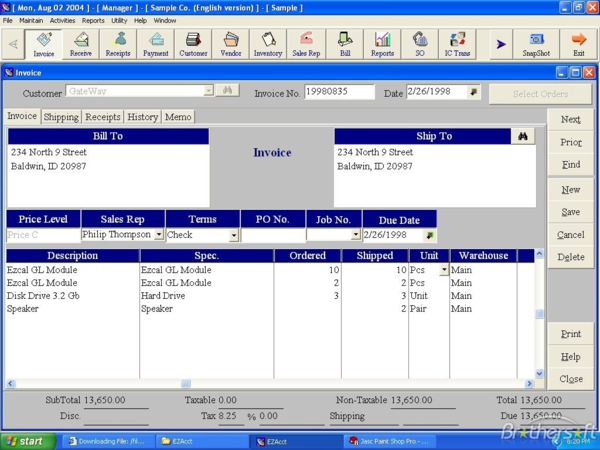

As technology advanced, certain companies began to believe that this was NOT a reasonable fee to pay. They decided to develop software that would come out within the next few years and ideally would take over the personal tax-preparation market. One such example is TurboTax, a personal tax-preparation program developed by Intuit. The software costs under $150 for most people, and can be used for years at a time. It allows you to go through your own taxes in a clear and intuitive way, and makes it very simple to get your taxes done on time without having to pay a tax preparer.

As you can imagine, tax-preparation services in Los Angeles and around the world have been worried about these types of services. There may come a day when Intuit decides to not only go after the personal tax-preparation services, but also corporate tax services. If this ever happened, they would have something serious to worry about. Tax-preparation at a corporate level is extremely expensive and can result in millions of dollars of revenue for a tax-preparation service from one company alone. If software can automate most of that work, you can imagine what it would do for the accounting industry. There’s a good chance that they would get completely obliterated by this disruptive technology and many jobs would be lost.

Technology and Government = A Bad Combo for Accounting

Accounting faces attacks from another front as well, this one less technological and more bureaucratic. The government, and the IRS in particular, have been lambasted time and time again for the overly complex rules and regulations that govern both personal and corporate taxes. In fact, many people believe that the complexity stems from the lack of technology and openness when these laws were first developed. They believe that coming up with an automated and simple way of preparing taxes using the current rules might lead the charge to simplify the rules in general. If this ever happened, accountants would be hurting, since most of their value comes from the fact that they have put in the time to understand these complex rules and work with them quickly and accurately.

While these developments might be a ways from happening, it’s still something that must be considered, especially if you are an accountant that is just getting started in your career. You have to be aware of the potential changes that could develop in your profession in order to be able to make an informed decision as to whether you want to continue being an accountant or perhaps make the jump for greener pastures in the future.

By Richard Orban, on behalf of WallaceAPC. Wallace is the best source for Los Angeles based accountants.