Intestacy – What to do

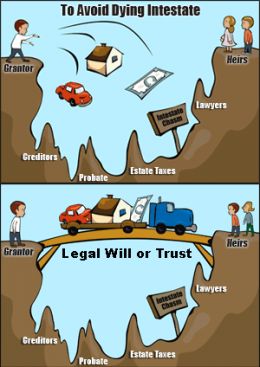

When someone is said to have ‘died intestate’, it means they have died without having made a will. It can also apply when a will has been made, but when that will does not cover additional property, assets or money accrued in the intervening period since the will was made; this remaining estate is termed ‘intestate estate’.

If one of your family members or someone close to you has died without having made a will, you should contact a solicitor as soon as possible. While intestate law has been created to outline how property, possessions and money are divided among relatives, the process can take months or even years in some cases.

Firstly, someone needs to be appointed to take care of the deceased’s estate. This is normally a spouse or close family member. In order for this to happen, such a person must apply to the Probate Registry for a ‘Grant of Letters of Administration’. Once this has been granted, it provides proof to banks and other organisations that that person does indeed have the right to distribute the deceased’s assets.

Inheritance tax must be paid either in part or in full before the administrator can go about dividing up assets and funds.

There are situations whereby a Grant of Letter of Administration might not be required; if the entire estate is valued at less than £5,000 and does not include any other property, or if the whole estate was jointly owned by another person, who would, ordinarily, take ownership of the deceased’s assets, then a grant may not be required.

Intestate – rules governing who will inherit what

There are many rules governing who will inherit what if someone has died intestate. If the person was married or in a civil partnership with someone, then that individual will inherit the deceased’s assets – although they may not inherit all of them; how much they get depends on if there are any other surviving close relatives, and how big the inheritance is. A different set of rules apply whether the person died before or after 1st February 2009, and are complex.

If there are no identifiable heirs, then the deceased’s estate ‘escheats’, or is legally passed over to, the Crown. In cases in which the person lived on either the Duchy of Cornwall or Duchy of Lancaster estates, then the person’s estate is passed to those entities. In rare situations a discretionary distribution might be made to someone who would not ordinarily receive anything under inheritance laws.

If a person was the deceased’s partner but no will had been made, then they would not be entitled to any inheritance. However, a claim can be made using legislation from the Inheritance (Provision for Family and Dependants) Act 1975. You would normally have to be a child, spouse, civil partner, or dependant of the deceased in order to make such a claim, and furthermore prove that you were wholly or partly maintained by them. This can be difficult to do, particularly if you both made contributions to your life together. Any claim should be made within six months of the deceased’s death, and may not succeed. If you have queries regarding intestacy, its required processes, or any legal ramifications, you ought to seek the advice of a solicitor

Written by James Sheehan, a passionate blogger with past legal experience