Direct Debits are fast becoming a preferred method of payment, especially here in the UK where 33 million people opt to use the automated service over more conventional methods of payment i.e. cash or cheque. More than 3.2billion Direct Debits were processed in the UK during 2011 compared to 2bn in 2000 and 836,500 in 1990. And over half of UK utility and household bills are paid using a Direct Debit including gas and electricity, mortgages and satellite bills.

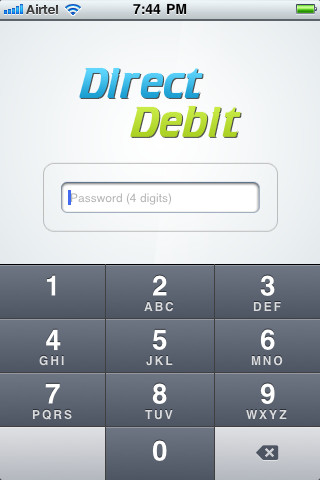

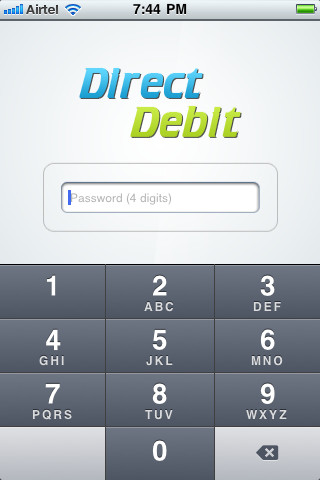

When discussing Direct Debiting, many people are under the impression that they can only set up a Direct Debit using a paper mandate or Direct Debit Instruction. These are just paper-based forms that include the necessary details needed to set up a Direct Debit application. You can also create Direct Debit application face to face, over the telephone or through a website; all you need is a list of your bank details and relevant personal details (name, address, contact number etc).

Another misconception surrounding Direct Debiting is that they are the same as Standing Orders- this is not true. A Direct Debits is a customer’s instruction to an organisation to take money from their bank account. A Standing Order is an instruction a customer gives to their bank to make a series of regular payments of a fixed amount on a set date. Direct Debits offer a lot more freedom as cancelling a Standing Order can produce a number of administrative problems, whereas a Direct Debit can be easily adjusted to change the amount and the date of payment.

There is a common concern encircling Direct Debiting; that it is not a safe or secure method of payment. Direct Debit is the only payment method with a money back guarantee which is offered by all banks and building societies that accept the automated payment scheme. If any changes are made to: the amount, date or frequency of your Direct Debit you will be notified at least ten working days in advance to provide sufficient time to accommodate this adjustment.

Furthermore, opting to pay through setting up a Direct Debit application can save you money. Many utility or service providers will offer a discount as a reward for choosing to pay with a Direct Debit Instruction as opposed to cash or cheque. The reason for this is the convenience that automated payments provide as a company does not have to go to the bank to pay cash or cheques in with Direct Debiting.

Smart Debit are a specialised Direct Debit Bureau that offers services including paper and paperless Direct Debits, credit cards, debit cards, cheques and postal orders at a low cost, transparent fee structure.

Things You Might Not Know About Direct Debit Applications