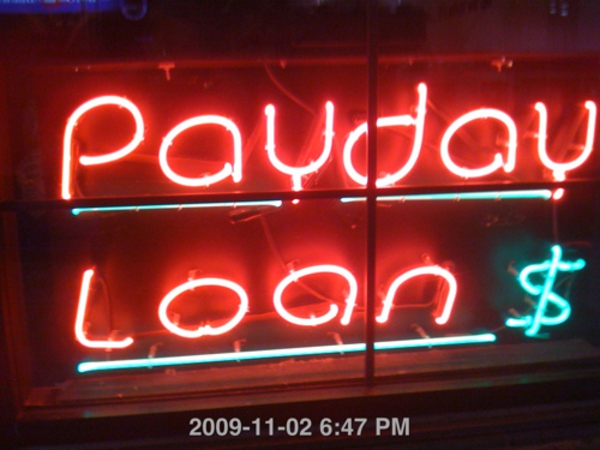

Payday loans are becoming an increasingly popular short-term solution to temporary financial difficulties. The industry has grown rapidly in recent years and, thanks to the introduction of new voluntary guidelines, borrowers can expect to see a series of improvements in the service they receive.

The changes to existing codes of practice are the result of extensive discussions between trade associations representing payday loan companies and the government. They are a response to criticism of the way a small number of payday loan companies were treating their customers, particularly those who fell behind with their repayments.

In some cases, customers who have found themselves in financial difficulty have seen the amount they owe rise sharply in a very short time due to ‘hidden’ additional charges that they were not fully aware of when they took out the loan. One company was found to be sending letters to customers who were failing to keep up with their repayments that accused them of committing fraud, implying that they could be arrested by the police as a result. Others have applied interest rates as high as 16,000 per cent.

The new guidelines, which will be in place from July 25th at the latest, will ensure all borrowers know exactly how much interest they are paying and what charges and penalties will be applied if they run into difficulties. The guidelines also mean that those who miss payments can expect to be treated in a more sympathetic and positive manner by payday loan companies. Changes could include penalty charges and interest being frozen or the term of a loan being extended so that smaller payments can be made over a longer period of time.

The guidelines are voluntary but have been adopted by the four trade associations that represent more than 90 per cent of the companies working in the short-term finance and payday loan business. The associations will monitor their members to ensure they are complying with the codes of practice and firms that fail to do so risk being expelled from the associations.

The number of businesses offering payday loans, pawnbroking services and similar ways of acquiring short-term cash has grown dramatically as a result of the recession. The industry is currently valued at £1.7 billion, five times what it was worth several years ago.

Payday loans continue to be of huge benefit to many. In the event of an emergency such as a burst pipe, a flat tyre or a similar unexpected expense, they can provide a valuable financial buffer until the next payday, when the loan can be repaid in full. Whereas a bank loan can take days or even weeks to arrange, a payday loan can be agreed and the money transferred into your bank account in a matter of hours or even minutes.

Although such loans are usually associated with those on lower incomes, recent evidence suggests that they are also growing in popularity among more affluent households. Such loans are only available to those in regular employment and in order to qualify you will have to provide details of your income, usually in the form of recent pay slips.

Because payday loans are only ever meant as a short-term solution, rates of interest are significantly higher than those you would get from a bank or building society. For this reason, this type of loan should never be seen as a long-term financial solution. Failing to repay a payday loan on time will cause large amounts of interest to accrue, meaning that you will be required to pay back even more in the long term.

Citations:

- Image Credit

- Citation Credit

This news follows last years voluntary code of practice adopted by UK logbook loans companies. It is fully expected that the Payday Loan agreement will cover similar principles.